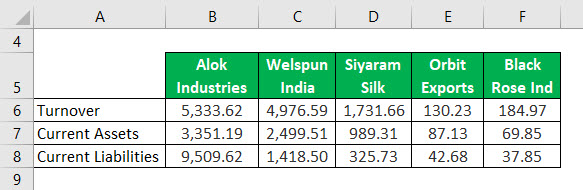

We have already seen that the total company’s sales when divided by the working capital, refers to the working capital turnover ratio. Advantages of Working Capital Turnover Ratio: It is used in future financial modeling of the business. You usually end up with enough capital when your current assets are significantly greater than your current liabilities. Working capital management is a term to explain the functions of keeping an eye on the cash flow situation and the current assets and current liabilities of a business. Sometimes, financial analysts also compare a particular company’s working capital turnover ratio to the working capital turnover ratio of other companies that lie in the same industry and gather insights into how high or low this ratio is comparatively. In the future, this could lead to a condition of bad debts (loaned money that cannot be recovered) and inventory that is redundant and outdated. Similarly, a low ratio of the working capital turnover ratio indicates that your business operations are not all that successful and effective.Ī company’s working capital turnover ratio is used to determine what its cash flow situation is and whether it can pay off its debts in a timely fashion or not in the near future.Īdditionally, a low ratio of working capital turnover of a business may also indicate that there are too many accounts receivable and inventory used in supporting sales. Obviously, a high turnover ratio suggests a more efficient and profitable business. This is a figure that accurately measures how efficient each dollar of working capital has been in earning revenue for the company or business and strengthening its financial situation. The amount of working capital turnover that a company generates is a figure that is of significance to every business, but more for small businesses.

However, there are other insights too here which we will consider shortly. Usually, a higher company’s net sales to working capital ratio mean a more financially successful company (though an excessive amount of turnover has its own drawbacks). It also provides insights as to how well a company has been utilizing its working capital. The working capital turnover ratio is an important reflection of the company’s operations, management, and the company’s success. What Does Working Capital Turnover Tell You? This working capital turnover formula is standard and used across all kinds of industries, whether big or small, product- or service-based. The resultant ratio is your working capital turnover ratio. You simply divide net sales generated in a particular time period (a year, for e.g.) with the net working capital used in the same corresponding period of time. We have already seen that the working capital turnover is a measure or a ratio of the total sales of a business in a specific time period, 1 financial year, for example, divided by the total working capital needed or utilized during that year.Ĭalculation of the working capital turnover ratio formula is simple and easy.

Working capital turnover adalah how to#

How to Calculate Working Capital Turnover Ratio? When you calculate the working capital turnover, it helps an individual determine how profitable a business has been in a fixed period of time –half-yearly or annually.

If you wish to consider the average working capital, you need to sum up the various amounts of working capital used over a time period and then divide them by a single measure of the time period –in years or in months. Simply put, it is the measure of net annual sales of a business in terms of the working capital needed for making those sales in a definite time period, usually a year. Working Capital is calculated as the difference between the company’s current assets less its current liabilities.Īs an extension, the working capital turnover is expressed as a ratio. What is Working Capital Turnover?Ī simple definition of working capital is the amount of money or capital that goes into the day-to-day operations of a business. This is why the concept of working capital turnover and the working capital turnover ratio is important from the point of view of studying the current financial status of any business and determining its exact sales growth. Net sales figures and the amount of profit are also indicators of how well a business has been doing.īut when you compare the business’s working capital to its turnover ratio for a fixed period, say for 6 months or a year, you get a more specific idea about how much each dollar used as working capital has earned for the business. Or you can look up the income it earned via a profit and loss statement. You can find out information about its revenue generated in a particular period of time, say a year. There are several ways to determine the success or profitability of a business.

0 kommentar(er)

0 kommentar(er)